Beijing, April 10, 2025 — In a bold retaliatory move, China has announced it will impose tariffs of up to

84% on a wide range of

U.S. imports, responding directly to a fresh wave of tariffs imposed by former U.S. President

Donald Trump. The decision marks a dramatic escalation in the

U.S.-China trade conflict, which continues to roil global markets and international diplomatic relations.

China’s Move: A Strategic Counterpunch

The Chinese Ministry of Commerce confirmed the new tariffs late Tuesday, stating that they were necessary to "safeguard China's economic sovereignty and interests." The tariff hikes are set to affect over

$120 billion worth of U.S. exports, including agricultural products, automobiles, and high-tech components — sectors where American exporters have significant stakes.

Trump’s Tough Talk Sparks Backlash

Trump, who is actively campaigning for a return to the White House, has repeatedly vowed to impose

"unrelenting economic pressure" on China if elected again. Last week, he proposed a

60% tariff on all Chinese imports, reigniting fears of another prolonged trade war similar to the one that rocked global trade during his first term.

Read more about the previous U.S.-China trade war.

Political Calculations Behind the Tariffs

China's response appears carefully calculated. By targeting sectors that heavily support Trump politically — such as

Midwestern farmers and

auto manufacturers — Beijing may be hoping to influence U.S. domestic politics ahead of the 2024 elections. According to Chinese state media, the tariffs will be “adjusted as needed” depending on U.S. actions.

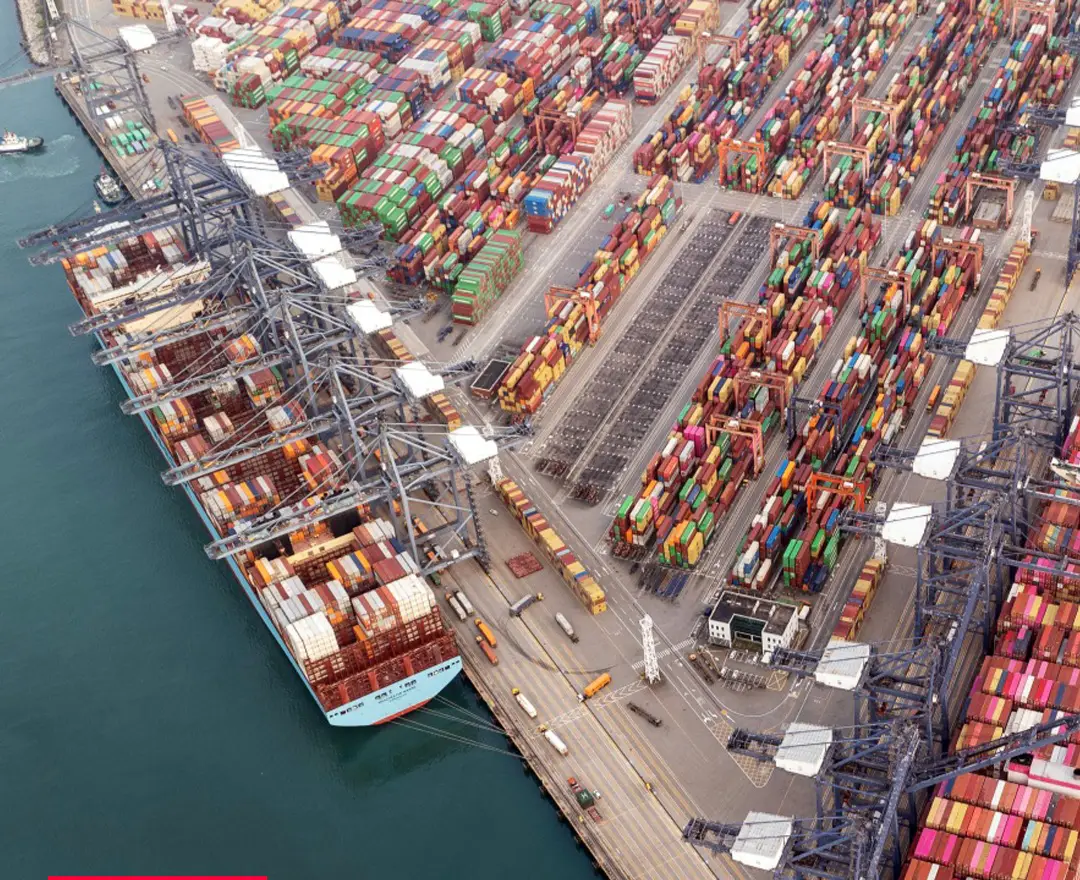

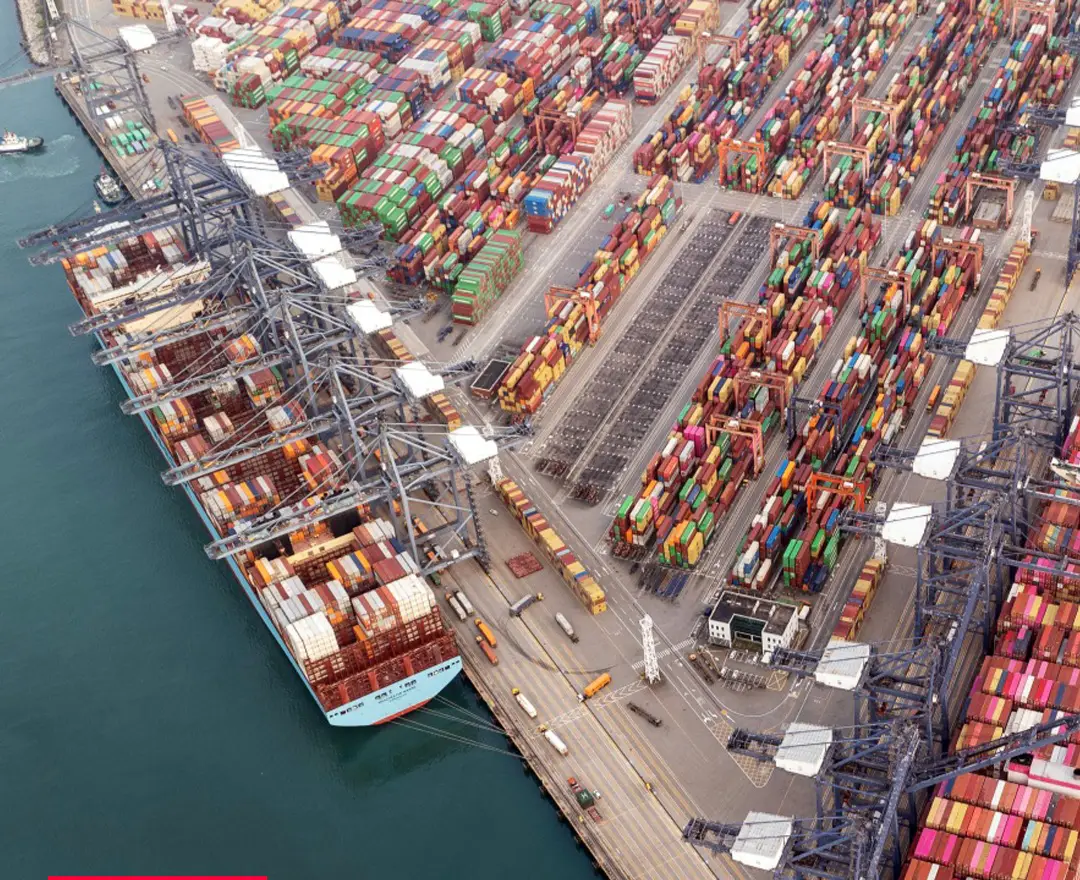

Global Markets React Swiftly

The implications of this tit-for-tat escalation are vast. Global markets reacted sharply, with the

Dow Jones Industrial Average shedding 450 points in early trading. Analysts warned that prolonged trade tensions could impact

supply chains, especially in tech and agriculture. “An 84% tariff is a near-total blockade of U.S. goods entering China,” said Dr. Amanda Lee, a trade economist at the

World Trade Institute. “This will have ripple effects across Asia, Africa, and Latin America.”

Impact on Emerging Economies

Economists also worry about the impact on

emerging economies that rely on trade with both nations. For countries like

Zambia, where trade with China plays a significant role, and where U.S. economic policies influence financial institutions and aid flows, this conflict could lead to

reduced foreign investment and increased inflation.

Explore how Zambia is responding to global trade shifts.

Uncertain Road Ahead

While some analysts argue that Trump's approach may coerce China into new negotiations, critics warn of unpredictable fallout. “The last trade war ended with partial deals and billions in losses. This round could be worse,” noted Michael Santos, former adviser at the

U.S. Trade Representative’s Office.

China’s Internal Strategy

Internal Chinese policies are also at stake. Facing

sluggish growth, youth unemployment, and rising debt, Beijing may use the U.S. tariffs to rally domestic support and promote

self-reliance in manufacturing. Already, Chinese firms are pivoting to other markets, particularly in Africa and South America, to reduce dependency on U.S. trade.

Calls for Dialogue Amid Rising Tensions

Despite the turbulence, both sides have left the door open for dialogue. The Chinese foreign ministry emphasized that “conflict benefits no one” and urged Washington to reverse course. Meanwhile, the

Biden administration, distancing itself from Trump’s rhetoric, stated it would “evaluate all policy options to ensure economic stability.”

For now, businesses and investors must brace for a volatile period. Supply chain diversification, rising commodity prices, and shifting political alliances will likely define the global economic narrative in the months ahead. As this new chapter of the

U.S.-China trade war unfolds, nations around the world will be watching closely — and preparing to adapt.